By JP Schwmon

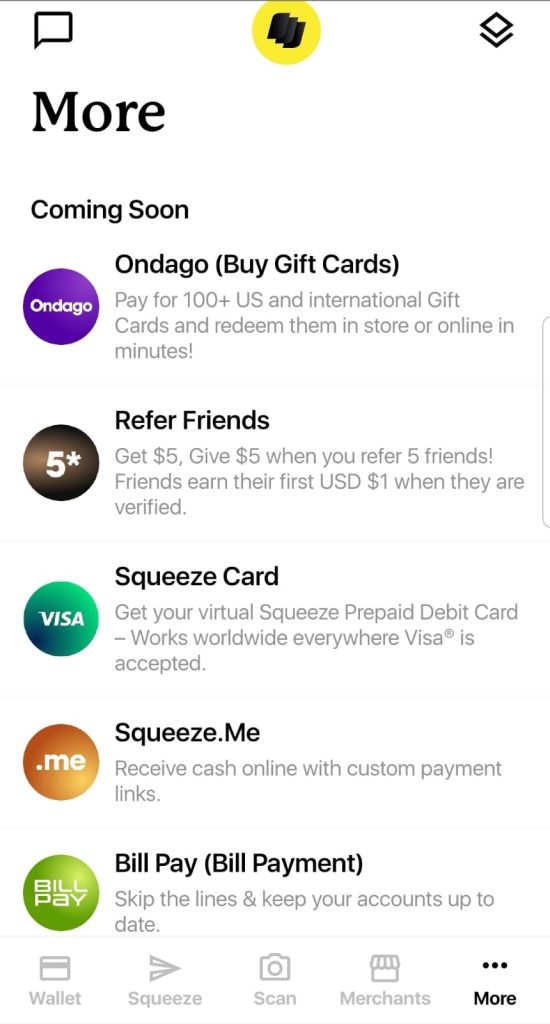

Squeeze Cash – the Caribbean’s only multi-currency mobile payment app – has introduced its network-wide, VISA powered, virtual debit card.

The introduction of the virtual VISA debit card “increases access to the digital economy that enables secure e-commerce payments globally”, a release from the Vincentian headquartered fin-tech operation noted.

“Squeeze Cash is the first in the Caribbean to offer a virtual debit card that is linked to a mobile app. This new feature enables Squeeze Cash customers to make secure e-commerce payments globally. This move is expected to empower Squeeze Cash customers – especially those without a bank account – to access the digital economy and engage in transactions online,” the release detailed.

The Squeeze Cash digital payments wallet enables its users to make and receive payments using their mobile phone since its 2019 launch. With the addition of the VISA virtual (non-plastic) debit card to the wallet, users can now make payments to local and global online merchants that accept VISA.

Squeeze Cash cofounder & CEO, Kenrick Quashie, said:

“We are proud to lead the way in launching our VISA supported virtual debit card across the region. This ensures greater financial inclusion through affordable products and services that cater to everyone and are easily accessible through a mobile device at any time.

“The expansion of Squeeze Cash services is an important step forward in improving access to the digital economy.

“Caribbean folks are increasingly shopping online, yet many people are left out as they lack the financial tools needed for e-commerce. The access to the virtual VISA debit card network bridges the divide by giving users instant access to a virtual payment solution through Squeeze Cash, without compromising the safety and security of transactions.

“Together with our partners, we are helping more people to benefit from the choice and flexibility that a growing, inclusive digital economy brings. We are so grateful to our partners for making this possible”, Quashie further stated.

The Squeeze Cash virtual VISA debit card gives customers the flexibility to shop safely and conveniently. Customers simply create a virtual card on their profile; link it to their digital wallet and transfer funds from their wallet to the card.

To pay for purchases, users receive a virtual debit card – including a 16-digit card number, security code and expiry date – which they use to complete any online purchase much like they would with a physical card.

The virtual debit card solution is safely stored on the Squeeze Cash app and customers can temporarily block, cancel or replace their card via the app, providing them with additional security and control.

New users joining the Squeeze Cash platform should have their government issued photo identification handy. An active email address is also needed though a local bank account is not required to access the new virtual VISA debit card feature.