Having seen the press release from the Ministry of Finance as it relates to the new import tax regimes for vehicles, I could not stay silent. The release was tactfully put together to give the impression that the reduction that you see will equate to total cost reductions; however, that is not the case. Let me use a light-hearted example that captures the essence of the comparison between the old and new vehicle tax-regime. In 2021, you could buy a one-scoop vanilla ice-cream for a total cost of $4.00 Eastern Caribbean Dollars (XCD), because that is your budget and you may not be able to afford a two-scoop vanilla ice-cream. In 2022, the one-scoop vanilla ice-cream has a 15% discount, but the total cost is now $13.00 XCD, due to some autocratic and arbitrary change in the ice-cream surcharge. This increase is outside the scope of one’s budget.

Does that discount help, or is it a smokescreen? The new import tax regime for vehicles is the brainchild of a young man (who is a former island scholar and cricketer) stationed in the Ministry of Finance. This idea by the young lad was very eagerly accepted by Finance and Cabinet. Once Cabinet approved the proposal, the Customs was then instructed to incorporate the relevant changes into their Asycuda system. I call this new change the Greedy Bill 2.0 for two reasons.

The first reason is due to disingenuous statements by various Ministers who try to sell this new tax regime as beneficial to the citizens of this country. The question one should ask is which citizens would benefit, and that leads to my second reason.

The second reason is that this greedy bill serves to benefit Ministers of Government, persons at the highest levels in Government and statutory corporations, who already receive vehicle concessions. If you do not fall within this minute percent, then “crappo smoke yo pipe” as we say colloquially. The rich get richer, while the other 97 – 99 percent have to pull out more money to buy a vehicle.

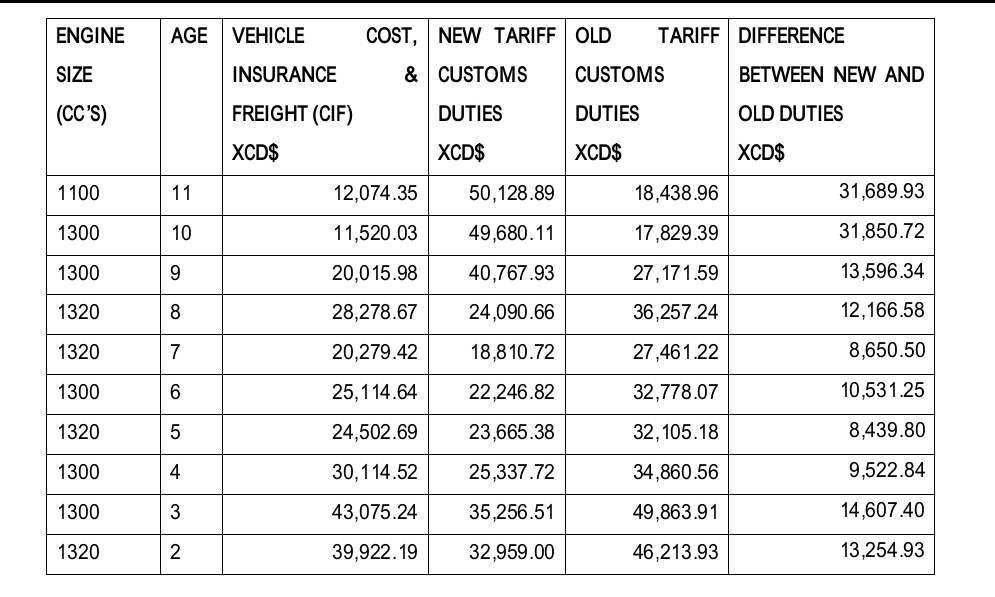

Kindly look at the table below and see comparative information abou some real vehicle costs from reputable vehicle websites, and the contrasting duties between the old and new vehicle regimes.

In order to get the total cost borne by the citizen under the old vehicle regime, add the vehicle CIF figure (3rd column) with the old tariff customs duties figure (5th column). To get the total cost to the citizen under the new vehicle regime, add the vehicle CIF figure (3rd column) with the new tariff customs duties figure (4th column).

Forget all the talk of a decrease in import duty and ask yourself, does your money go further? Is it more expensive for you to buy a vehicle under this new vehicle regime?

According to the 2022 budget speech by the Minister of Finance, the average total landed cost of vehicles imported under the old regime was $27,000 XCD. So, before the Greedy Bill 2.0, a person could import a small engine vehicle with a budget of $25,000 to $28,000 XCD (this includes the cost of the vehicle and customs duties). Now, with this new regime, the average citizen will have to operate on at least a budget of approximately $39,000 to $40,000 XCD (which is an additional $12,000 to $14,000 XCD) to purchase a vehicle. The average citizen will be incurring more debt. Think about what that additional money could do for existing mortgages, medical bills, school bills, family health care, child health care, groceries, vehicle maintenance, home maintenance; and so on.

Do the creators and approvers of this modern and insensitive greedy bill care? When told that this vehicle proposal is not for the normal working people, it was said by a senior member of the Ministry of Finance that, “Vincentians will find the money as usual”. This insidious and callous statement is common of entitled and privileged people who have and do not care about those who do not have.

Classic case of the haves and haves not. This proposal by the young man and acceptance by the powers that be depicted a serious divorce from reality as it relates to increased unemployment and cost of living, due to the economic complexities created by the eruption of Soufriere, Covid-19, and the ongoing saga between Russia and Ukraine.

I really hoped that this new vehicle regime was going to benefit all citizens. I thought it was going to bring a time of respair, but all it is doing is taking the majority of citizens further into despair.

Who feels it knows it, and Jah knows I feel it.

A very concerned and disappointed citizen